The Growth of the Gaming Industry

According to Newzoo's Global Games Market Report, Gamers will spend about $137.9 billion this past year on games. They are expected to spend about $151.9 billion in 2019. If you look at previous years' gaming revenue, you will notice a trend:

It's important to note that online gaming is an incredibly complex topic to analyze, given not only the myriad of factors involved but the constantly changing nature of the market. Statistics from just a year ago can only tell a partial story, and consumer demands can turn on a dime. All of this being noted, the one constant is rapid growth other industries only dream of.

Increasing Player Bases, Revenues, and Investments

Gaming, much like other forms of entertainment, has become a huge industry. Here are a few statistics and fact to show you how far it's come since the days of the Atari and the NES:

The online gambling industry is also witnessing an increasing risk of app-based hacking. In addition, compulsive gambling can affect an individual’s health and personal relationships, leading to issues such as depression or debts. Report Coverage & Deliverables PDF report & online dashboard will help you understand.

- Newzoo's 2018 predicts that by 2021 consumer spending on games will be about $180 billion, climbing at a steady rate over the years.

- Filmora indicates that there are currently 2.341 billion gamers worldwide in 2018 and that by 2021 that number will rise to 2.725 billion.

- As of September 2018, the game Pokémon Go alone has generated $2 billion in revenue.

- Even going so far back as 2016, the revenues for video games surpassed those of the music and film industries combined.

- While most developers won't release budgets for modern games, the combined development and marketing costs of Grand Theft Auto 5 (released in 2013) totaled to about $265 million. Only the very largest films of all time (including their marketing costs) top that cost.

- The ESA reports that there are 2,711 video game company locations in the USA, and that there are about 65,678 people currently working for publishers or developers.

- As the internet’s answer to gambling, online casinos allow players to access their favorite casino games from anywhere with internet access using their computer or mobile devices. Despite opposing regulations, the global online gaming industry has shown rapid expansion over the past decade, and economists expect the trend to continue.

- Technological advancements across the online gaming industry are expected to favorably impact market growth over the forecast period. Regulatory shifts and the proliferation of smart devices are also expected to fuel market demand. However, a few government regulations banning online gambling may pose a threat to the online gaming market.

What Platforms Are Games Being Developed For?

According to information obtained ahead of the 2019 Games Developers' Conference, here is a rough divide on which platforms were being developed for alongside a few notes for each platform:

PC computers: 66 percent

- Nearly anyone can create a PC game. With a few tools and bought assets, you could likely develop a low-quality PC game by yourself in a manner of weeks.

- There are no licensing fees for PC and no devkits to buy.

- The market is potentially the largest, and the PC game scene is the most mod-heavy (mods are fan-made patches which provide new assets or functionality to a game) and many gamers prefer to use a more precise mouse a keyboard to play their game of choice.

- Regarding online gaming, PC is the easiest platform to have online play for.

Smartphones and Tablet Devices: 38 percent

- Mobile gaming has a strong hold on the total market (even more on that later), and generates a massive amount of income for gaming companies.

- Smartphone and tablet devices generally have the same games available to them based on the OS for the devices, either Android or the latest iOS.

PS4 Consoles: 31 percent

- As of March 2018, there were 34.2 million Playstation Plus (Playstation's online gaming service) subscribers.

- It should be noted that many of the popular games for consoles are single-player experiences, especially when compared to mobile devices.

Xbox One Consoles: 28 percent

- For most purposes nearly the same as the PS4, with the exception of some games exclusively produced for the PS4.

- There are very few exclusives for the console, but the online gaming base via Xbox Live has historically been very strong, with about 59 million active users.

Mac Computers: 20 percent

- Mac Exclusive games are nearly unheard of in the industry. Nearly every release is also available for the PC.

Nintendo Switch: 18 percent

- It should be heavily noted that this percentage is likely to increase heavily due to the success of the Nintendo Switch. Many developers expressed interest in the console for the future.

- Due to Nintendo's efforts, practices, and standards, there generally are fewer games allowed to be developed for the Switch.

- Nintendo's online service is currently too new to have concrete statistics on the number of users.

VR Headsets: 17 percent

- This number means the number of games that are not only developed exclusively for VR, but also games that have some form of VR support.

- VR is a growing, if small, market. According to statistics by Valve, about 0.7 percent of Steam users have a VR headset connected to their PC.

Web Browsers: 13 percent

- Many web browser games are simple browser versions or ports of mobile games.

- Many more, depending on what counted according to the poll, might be flash games that are more training or experiment than a product.

AR Headsets: 7 percent

- Many of these selections are experimental and not a large part of the overall gaming market. What will be interesting to the greater gaming industry is how popular AR devices and games become in the coming years.

- Given the profitability of titles like Pokémon Go, many developers (20 percent) are interested in exploring AR technology in some form or another in the future.

It should also be noted that a game can be and very often is developed for more than one platform at once, hence the percentages totaling far more than 100.

Additionally, it should be noted that just because a game is developed doesn't mean a game is popular. While we would love to have more sales data that can provide a greater background of the industry, many developers and companies like to keep their sales numbers under wraps to keep an edge up over the competition.

Gamers by Platform

According to the ESA 2018 Sales, Demographic, and Usage Data release, US households play games on the following platforms:

Differences by Region in Gaming

You might consider gaming in the Western context, but you should know that gamers are in countries all around the world, and the USA isn't even the top creator of game revenue. According to Filmora, the top 10 countries are as follows:

China is the greatest outlier here because many games that do well in America do not necessarily do so well in China. As mentioned earlier, this is due to the fact that China's gaming market is heavily focused on mobile revenues and microtransactions. Despite blocks on some games, in 2016 mobile games were responsible for more than 50 percent of all digital gaming revenue, and the trend has only risen from there. Newzoo suspects that by 2021 mobile revenue will make up a shocking 70 percent of gaming revenue in the country.

Japan, while the third largest market, spends the most money per person on games according to Newzoo (1.5 times the average North American gamer). The market grows about 15 percent each year and this comes as no surprise given the number of Japanese developers and publishers that have heavy footholds in the industry (recall that both Nintendo and Sony are Japanese companies).

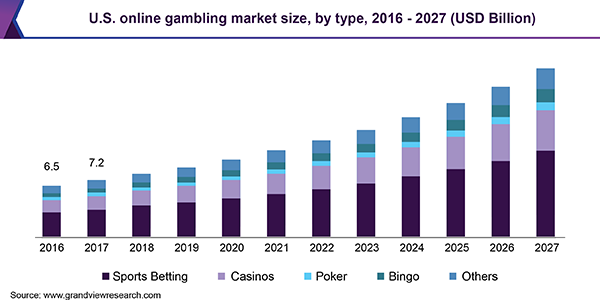

Online Gambling Industry Outlook

The main other consideration to note is that the cost of gaming is often more expensive in Western countries outside of the US, so European countries might not have such a strong gaming culture or as large of a player base.

Online Gambling Industry Statistics

The Average Gamer of Today

Online Gambling Industry Growth

While you might think of the average gamer as a younger male, you might be surprised to learn about some of these statistics regarding gamer demographics:

- The average gamer is 34 years old. The average male gamer is 32, and the average female gamer is 36. Younger gamers might dedicate significantly more time to the hobby as they have more time, but the market is skewing towards middle age as more people are growing up with games in their life.

- 45 percent of gamers are women, although it should be noted that the games men and women play vary. According to Newzoo, on the PC men preferred as their favorite genre shooter (41 percent), strategy (40 percent), and action/adventure (35 percent) games in that order. Women preferred action/adventure (36 percent), strategy (35 percent), and simulation (31 percent) games. The general trend shows itself across all platforms.

- Newzoo also notes that while the percentages of 'core gamers' (according to them gamers who play a game more than 5 days a week) are similar along gender lines, men are across the board more likely to pay for games.

- As far as self-reported core gamers, those who say gaming is an important part of their life, 70 percent are men.

The Direct Impact of Online Play

- According to the ESA data, 50 percent of gamers consider online play capability a factor into their purchasing decision. This was the fifth most common factor, with graphics, price, story, and game series being the first four.

- The same data notes that 56 percent of the most frequent gamers will play multiplayer games with other online an average of 7 hours a week.

- Of frequent gamers, 55 percent say that video games help them stay close with and connect to friends.

- Esports is also making a notable mark on the industry, with NewZoo noting that in 2017 22 percent of US male millennials watched esports. The $30-60 million price tag on an Overwatch League team slot also demonstrates the investments companies and individuals are willing to make on esports.

The Rise of Mobile Gaming

According to Newzoo's report, in 2018 mobile games will generate 51 percent of revenue for the industry, or about $70.3 billion. They suspect that by 2021 that number will top $100 billion, especially as more people adopt smartphones and more advanced smartphones (which better graphics processing) come to market. This would be unheard of five or even a few years ago, even to those who knew that the market was climbing rapidly.

- While tablet games make up $13.9 billion of that $70.3 billion made in 2018, smartphone gaming revenue totaled 56.4 billion, making it the clear winner for the future.

- Mobile gaming grew 25.1 percent in 2018 compared to the previous year.

The Fortnite Effect

You've probably heard of Fortnite, and it's one of the few games that's universally caught on with kids for a few reasons. We would like you to consider these statistics in the scope of the larger market and would also like you to see it as an example rather than something special in itself. There will be other Fortnites, but these trends will repeat themselves:

- LendEDU performed a survey that found that 68.8 percent of Fortnite players have spent money on in-game purchases.

- Of those spenders, the average amount spent was $84.67.

- For nearly 37 percent of those spenders, this was the very first time they have made an in-game purchase.

- The poll found that the average player spends six to 10 hours a week playing the game.

- LendEDU also found that out of students who played the game, 35 percent have skipped class to do so. Also, 20.5 percent of workers surveyed have skipped work to play it.

- According to Bloomberg and Gamesindustry.biz, as of November 2018, the player base totals about 200 million, and it's only been growing since. To put it into perspective, the user base of Fortnite is likely larger than the population of all but four countries.

- According to Verto Watch, 62.7 percent of players are between the ages of 18-24. What we can take away from this stat is that the Fortnite audience skews very young compared to the greater gaming population.

- The Verto Watch results also note that 72.4 percent of players are male, and 27.6 percent female. Given the popularity of shooters among males, this comes as no surprise.

It's noteworthy that Fortnite is a free-to-play game, albeit a high budget one. A nearly 70 percent conversion rate is absurd compared to the industry average of about 5 percent. And compared to the 'whale' model in which in most games where one percent of players spend by far the greatest amount of money on the game, Fortnite has a bit more even distribution.

The main takeaway we can expect from this is that game developers and publishers are going to try and emulate the features and successes of the titan in hopes of getting some of that market share, much like how the MMO market flooded with clones after the runaway success that was World of Warcraft.

Conclusion

More than most industries, online gaming is a market that can turn in a matter of months or even weeks, as gamers seek to find the hot new game or developer changes drive customers away towards newer markets and products. Overall, we generally ask that you don't consider the ups and downs of games and publishers individually but the industry as a whole. That will be the only way to truly understand where online gaming is headed beyond the next year and know what you can be exited and concerned about.

We also ask that if you game yourself or if you have family members that play video games, you consider their habits and health with gaming as well. The stats and details on gaming addiction aren't in yet (whether it exists is still up for debate), but some of these stats can be alarming and you should protect yourself and your family from potentially predatory practices that may be occurring or will occur.

We hope that you have all the information you need now, and we encourage you to share this post or ask questions if you want to know more.

Dublin, Nov. 19, 2020 (GLOBE NEWSWIRE) -- The 'Analyzing the Global Online Gambling Industry 2020' report has been added to ResearchAndMarkets.com's offering.

There is hardly any industry that has not been affected by the COVID-19 pandemic. The COVID-19 pandemic has had a huge impact on the global gambling industry. The pandemic led to the closure of casinos, gambling venues like bars, breweries, bingo halls, horse racing, and others, as well as lottery outlets. A suspension of sporting events also affected the gambling industry worldwide.

However, one industry that has seen a surge in growth has been the online gambling industry. The pandemic and the lockdown that followed led to a sudden surge in visitors to casino and gambling websites. In fact, due to people sitting locked up in their homes and not having anything exciting to do, many tried their hands at playing online slots or other live dealer games. Many online casino sites found new subscribers, while the regular players also made it a point to play online, marking a paradigm shift in the way the traditional gambling industry used to function.

About 51% of the world's population takes part in some form of gambling every year, thus signifying obvious financial benefits from online gambling websites. With the expansion of the online gambling industry, players have come to expect only the highest quality of online gambling facilities. New features and regular system updates are needed to maintain the websites to stay ahead in the market. Online gambling may be rather intimidating to both a novice and an expert player because of the endless options on the internet. Casino.org is an online directory that aids gambling participants find the top online casinos that are safe, secure, anti-spam, tested and trustworthy from around the world.

Online gambling players like BetWinner have been offering their services and enjoying good fortunes even during this global health crisis. In fact, many online gambling sites have reported enjoying greater rates of engagement than ever before. It looks likely that the online gambling industry is probably going to be one of the very rare sectors that can make it through this global pandemic with significantly lesser financial damage than other business sectors, including that of land casinos.

The publisher analyzes the Global Online Gambling Industry in its report Analyzing the Global Online Gambling Industry 2020.

The report begins with an industry definition and moves on to the complete industry analysis. An analysis of global casinos and online gambling industry is carried out in section one. In this section the author looks at industry statistics, industry revenue growth, industry segmentation and the major products & services of online gambling and other services. They also analyze the major regions, industry trends, market share, industry competition and a look at what the future holds for the global casinos and online gambling industry. They also analyze the Global Online Gambling Industry in a Porter's Five Forces Framework Analysis.

Next the publisher analyzes the factors that impact the global online gambling industry, including the COVID-19 pandemic, mergers and acquisitions, the impact of regulations in various countries, factors driving demand in the industry, industry costs, industry globalization, and the high barriers to industry entry, amongst other factors.

Moving on, they analyze online and mobile gambling versus traditional gambling. They also analyze the industry statistics for the global online gambling industry along with value analysis and an industry segmentation.

A forecast for the global online gambling industry till 2023 is included in the report. This report also analyzes the major players in the global online gambling industry.

Key Topics Covered:

1. Executive Summary

2. Industry Definition

3. Global Casinos & Gambling Industry

3.1 Industry Overview

3.2 Industry Value Analysis

3.3 Industry Segmentation

3.4.1 Segmentation by Categories

3.4.2 Segmentation by Regions

4. Global Online Gambling Industry

4.1 Introduction

4.2 Industry Overview

4.3 Industry Value Analysis

4.4 Industry Revenue Growth

4.5 Industry Segmentation

5. Global Online Gambling Industry: Major Products & Services

5.1 Overview

5.2 Online Gambling

5.3 Other Services

6. Global Online Gambling Industry: Analysis of Major Markets

6.1 Europe

6.2 France

6.3 United Kingdom

6.4 North America

7. Global Online Gambling Industry: Porter's Five Forces Strategy Analysis

7.1 Introduction

7.2 Bargaining Power of Buyers

7.3 Bargaining Power of Suppliers

7.4 Competitive Rivalry in the Industry

7.5 Threat of New Entrants

7.6 Threat of Substitutes

8. Factors Impacting the Industry

8.1 Impact of COVID-19

8.2 Industry Trends

8.3 Impact of Mergers & Acquisitions

8.4 Impact of Regulations

8.4.1 US Regulations

8.4.2 France Regulations

8.4.3 Germany Regulations

8.4.4 Italy Regulations

8.4.5 UK Regulations

8.5 Factors Driving Demand

8.6 International Trade & Impact

8.7 Industry Costs

8.8 Increasing Globalization in the Industry

8.9 High Barriers to Entry

8.10 Impact of Technology

9. Industry Competition & Market Share

10. Online/Mobile Gambling versus Traditional Gambling

10.1 Introduction

10.2 Retail Gambling

10.3 Growth of Online & Mobile Gambling

11. Global Online Gambling Industry: Forecast

12. Major Industry Players

12.1 32Red Plc

12.2 888 Holdings Plc

12.3 bet365

12.4 Betfair

12.5 Flutter Entertainment

12.6 GVC Holdings PLC (Ladbrokes Coral Group)

12.7 International Game Technology PLC

12.8 Kindred Group Plc

12.9 La Francaise Des Jeux

12.10 Netplay TV Plc

12.11 Playtech Plc

12.12 Scientific Games

12.13 Sportingbet

12.14 The Stars Group

12.15 William Hill Plc

12.16 Zynga

13. Glossary of Terms

Online Gambling Industry Analysis

For more information about this report visit https://www.researchandmarkets.com/r/ydwoq1

Online Gambling Industry

Research and Markets also offers Custom Research services providing focused, comprehensive and tailored research.